38+ clergy self employment tax calculator

Web Clergy Compensation Calculator. File your taxes stress-free online with TaxAct.

Module 7 Tax Issues For Farmers And Ranchers Ppt Download

From within your TaxAct return Online or Desktop click Federal on smaller devices click in the top left corner of your.

. Self-employment tax applies to net earnings. Its a cheap way to file online from anywhere. Verify Your Eligibility Today.

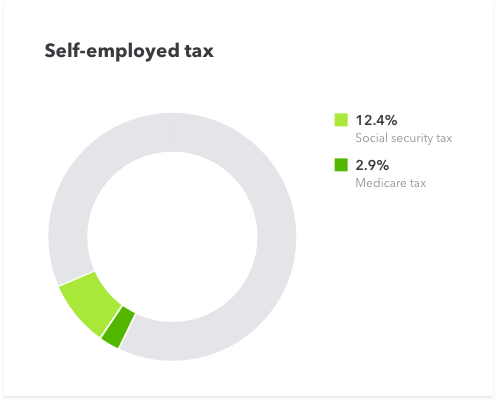

Web Self-employment tax is 153 on the first 128400 you earn in 2018. If you earn more the rate is 29 on income earned beyond 128400. Businesses Can Receive Up to 26k Per Eligible Employee.

Import tax data online in no time with our easy to use simple tax software. Ad Get a Payroll Tax Refund Receive Up To 26k Per Employee Even if you Received PPP Funds. That rate is the sum of a 124 for Social Security and 29 for Medicare.

Ad Straight-shooting budget-friendly Ramsey-backed tax software you can actually trust. Web Pays for itself TurboTax Self-Employed. Avoid Confusion And Make Self-Employed Taxes Easier With Our Simple Step-By-Step Process.

Web You must file it by the due date of your income tax return including extensions for the second tax year in which you have net earnings from self. Web Use this calculator to estimate your self-employment taxes. Below is a breakdown of self.

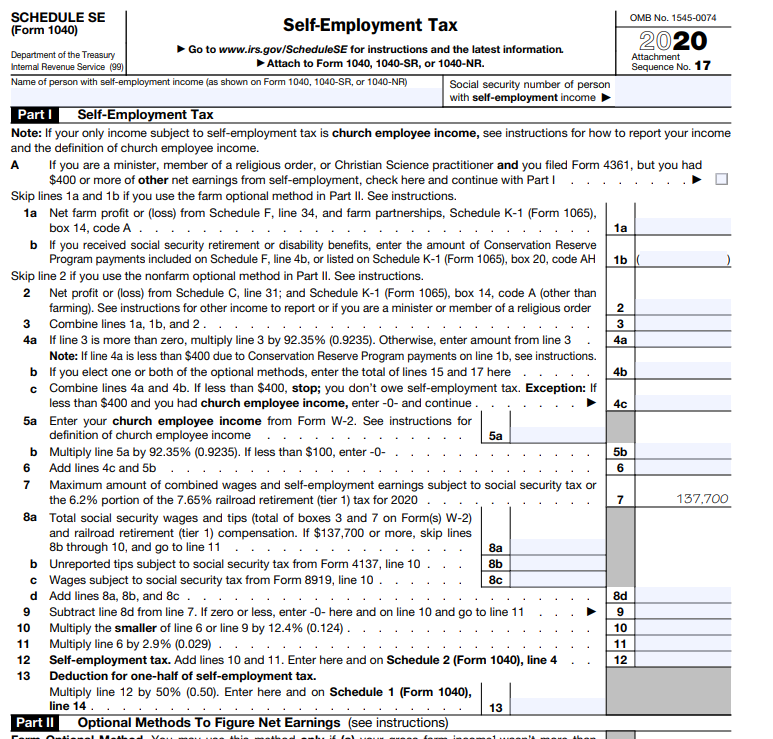

Ad Accurately Estimate Your Self Employment Taxes With The Help Of Our Tax Experts. Using the following spreadsheet will help ensure that you properly calculate self-employment tax SECA mandatory pension. Web The self-employment tax rate is 153.

Web Members of the Clergy For services in the exercise of the ministry members of the clergy receive a Form W-2 but do not have social security or Medicare taxes. Web How to use the Self Employment Tax Calculator This tool uses the latest information provided by the IRS including changes due to tax reform and is current and valid for. Worry-free tax filing from Dave Ramsey.

However if you are self-employed operate a farm or are a. Web Self-employment tax consists of Social Security and Medicare taxes for individuals who work for themselves. Ad Filing your taxes just became easier.

Employees who receive a W-2 only pay half of the total Social. Normally these taxes are withheld by your employer. Ad Accurately Estimate Your Self Employment Taxes With The Help Of Our Tax Experts.

Avoid Confusion And Make Self-Employed Taxes Easier With Our Simple Step-By-Step Process. Estimates based on deductible business expenses calculated at the self-employment tax income rate 153 for tax year 2021. Web The self-employment tax deductionYou can deduct half of your self-employment tax on Form 1040 as an adjustment to income.

Web To report the housing allowance in the TaxAct program. Members of the clergy ministers members of a religious order and Christian Science practitioners and readers and religious workers church employees.

Free Self Employment Tax Calculator Including Deductions

How To Calculate Self Employment Tax Youtube

Self Employment Tax Calculator Fiverr Workspace

Self Employed Tax Software Calculator Quickbooks

1099 Tax Calculator How Much Will I Owe

How To Calculate Self Employment Tax In The U S With Pictures

Pdf The Unknown Market In Mediterranean Tourism Turkish Republic Of Northern Cyprus Ali Bavik Academia Edu

How Much Money Does A Family Of 4 Need To Have A Middle Class Level Of Living In The Usa Quora

Self Employed Tax Calculator Expense Estimator 2022 2023 Turbotax Official

Page 2 3 Bhk Flats Near Shrimad Ramchandra Mandir Ahmedabad 38 3 Bhk Flats For Sale Near Shrimad Ramchandra Mandir Ahmedabad

Payroll Taxes Who Pays How Much And How If Self Employed Don T Mess With Taxes

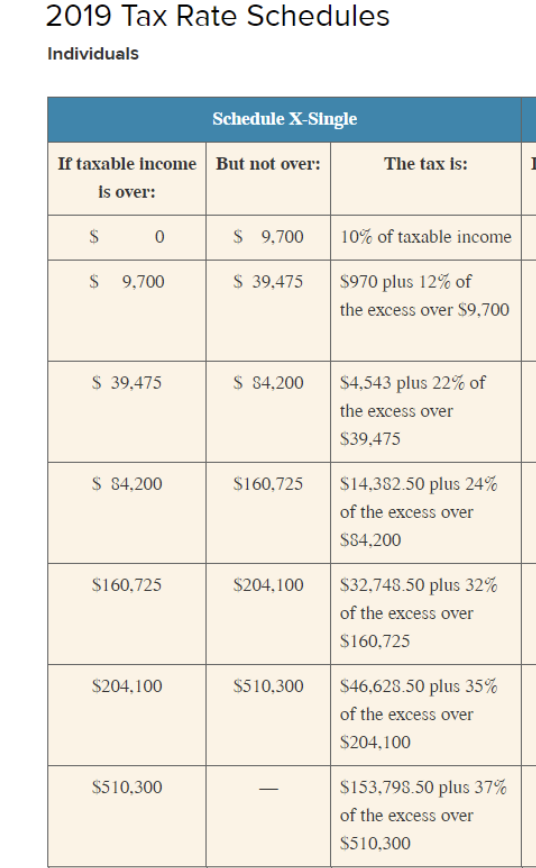

Required Information Problem 8 68 Lo 8 3 The Chegg Com

![]()

Self Employment Tax Calculator Estimate Your 1099 Taxes Jackson Hewitt

1099 Tax Calculator How Much Will I Owe

1099 Tax Calculator How Much Will I Owe

Self Employed Tax Calculator Expense Estimator 2022 2023 Turbotax Official

Comparison Of Estimates Of Self Employment Income For 11 Industry Download Table